Glazing and R&D Tax Credits

The UK Government’s R&D tax credits initiative offers an additional tax reduction of up to 33p for every qualifying pound spent on R&D. When a glazing company starts investigating, testing and trying to create new solutions to meet a job brief, process inefficiency or gap in the market, they are carrying out R&D.

GGF Partnership

Our GGF partnership means that any members of the GGF will now be able to avail of expert R&D tax advice throughout the year – all with a special 20% discounted rate on fees, which are only chargeable on successful claims.

Glazing Industries R&D Tax Credit Claim Examples

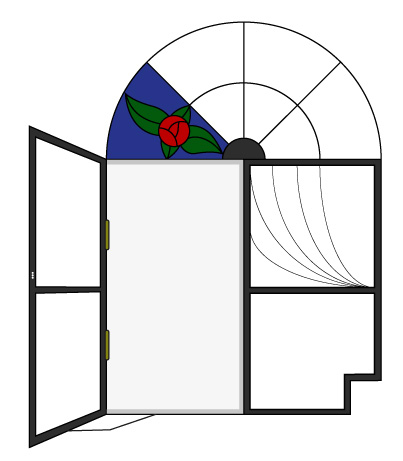

R&D tax credits could apply if the glazing job requires investigation and testing to create:

Unique, custom repair or protection work of historic glass pieces.

Replicating and refurbishing traditional glass and frame units. Keeping their aesthetics, but integrating modern glazing standards.

Specially crafted hinges.

Bespoke, new solutions that meet designers’ or architects’ specific visions.

Specially crafted locking mechanisms.

New technical designs, builds or installations of unique glass pieces or frames.

Specially crafted seals.

Specially crafted closing mechanisms.