UK Businesses Receive £7.4 Billion in R&D Tax Credits in 2019/20

In the latest R&D tax credit statistics, it has been revealed that the HMRC awarded innovative UK businesses a total of £7.4 billion in R&D tax credits in 2019/20, which is a 39% increase from the £5.3 billion 2018/19 figure that was reported last September.

In the year ending March 2020, SMEs claimed 64% or £4.7 billion, while the Manufacturing, Information and Communications, plus the Professional, Scientific and Technical sectors made up 64% of all claims and 69% of the total amount claimed.

SME and Large Enterprise Claims

Number of Claims

2019/20

£M Claimed

2019/20

Large Enterprises

SMEs

SMEs

Large Enterprises

Top 10 Claiming Sectors by Number

2019/20

Top 10 Claiming Sectors by £M

2019/20

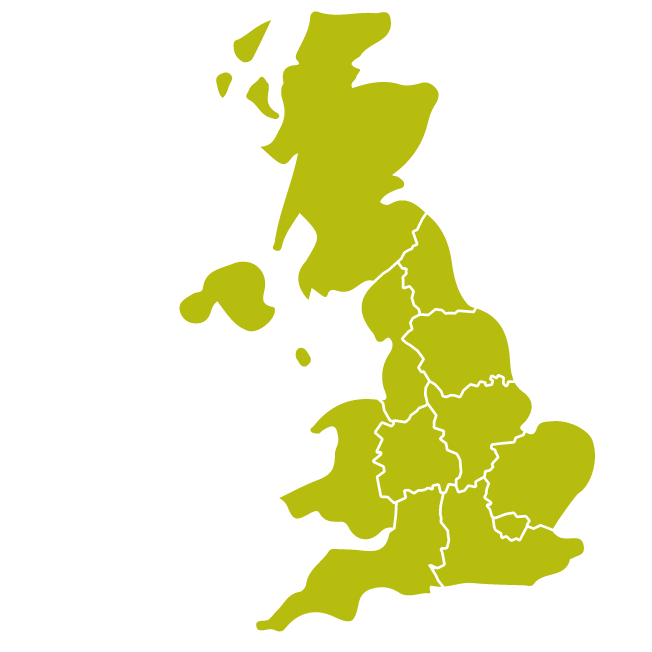

Number of Claims and Value per Region in 2019/20

Scotland

£330 Million

4,580 Claims

Northern Ireland

£135 Million

2,280 Claims

North East

£150 Million

2,760 Claims

Wales

£170 Million

2,940 Claims

North West

£500 Million

8,915 Claims

Yorkshire and The Humber

£310 Million

6,405 Claims

East Midlands

£355 Million

5,510 Claims

West Midlands

£635 Million

7,885 Claims

East of England

£840 Million

8,085 Claims

London

£2,325 Million

17,210 Claims

South East

£1,325 Million

12,740 Claims

South West

£355 Million

6,455 Claims

Isle of Man / Channel Islands

Less than £10 Million

15 Claims

Expenditure Used to Claim R&D Tax Credits

SME Scheme (2019/20)

2019/20 Total

RDEC Scheme (2019/20)

Number and Value of Claims by Cost Band

Number of Claims

2019/20

Value of Claims in £M

2019/20

All the above 2019/20 figures were reported in HMRC’s R&D Tax Credit Statistics 2021 release.

For more information on R&D tax credits, for advice or to find out how we can partner with your business please contact us.