IoD Director of the Year Awards – Large Business Sponsors

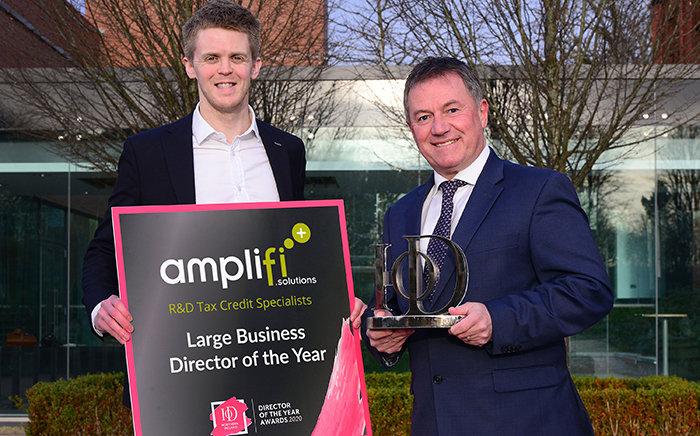

At Amplifi Solutions, we are delighted to sponsor the Institute of Directors (IoD) Director of the Year Awards 2020.

The awards, which this year celebrate their 10th anniversary, honour the achievements of directors representing a wide spectrum of organisations across the private, public, and third sectors.

And as sponsor of the Large Business category, we’re joining the IoD on the search for best performing leaders in Northern Ireland.

Making an entry is straight forward, completely free of charge, and can all be done online.

If you are not planning to enter yourself but have a colleague you think may be worthy, why not nominate them!

To enter or make a nomination, visit www.iodawards.com before the closing date of 13th February.

The very best of luck to all entrants – and we look forward to seeing you at the ceremony at the Merchant Hotel in May!