Growth for Amplifi Solutions

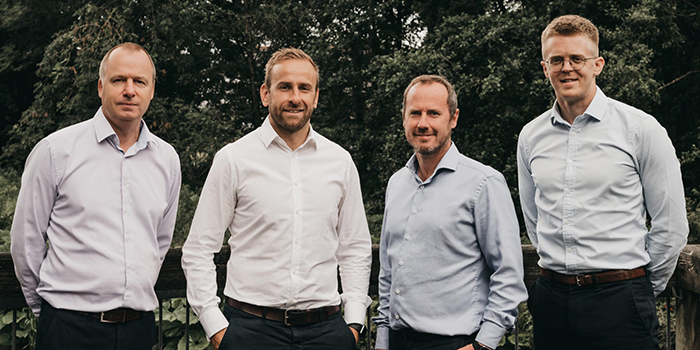

Research and Development (R&D) tax specialists, Amplifi Solutions, has announced major plans for company growth, including a new Scotland office space and expansion to their expert team.

In the last number of weeks, the organisation has recruited two new senior people; Jamie Watts has joined as Commercial Director from iMultiply, and Andrew Smythe as Client Manager, previously of Northern Ireland Chamber of Commerce.

The firm has also announced plans to expand into Scotland, with a new Edinburgh office opening in September. The company’s move across the water will open up its services to more potential clients than ever before.

Jeff Drennan, Managing Partner at Amplifi Solutions commented on plans for the next twelve months: “This is truly a very exciting period of growth here at Amplifi Solutions, not only for our team, but for our clients across the UK and Ireland. We are very pleased to welcome both Jamie and Andrew to their new roles, who bring with them a wealth of knowledge and experience that will benefit our clients to no end.”

Jamie Watts, Commercial Director at Amplifi Solutions said there was no better time to be joining the team: “It’s been a fantastic introduction to the business, getting out there and meeting our clients. Northern Ireland is rife with innovative companies and we see investment into research and development across a range of industries and professions. A new office in Scotland will allow us to deliver our existing levels of customer service to an even wider audience. Our message is simple – if you are a company that is innovating, then talk to us.”

The Ballyclare based team, including Management and Chartered Accountants, worked with hundreds of companies in the last year alone; providing an end-to-end specialist technical service that takes companies throughout the entire process – from an initial and free exploratory meeting, creation of the R&D claim, and submission to HMRC – all to you receiving your R&D tax benefit.

R&D tax credits can be awarded to any company proving they are undertaking steps in research or development – even when those projects don’t succeed. The tax breaks were introduced in 2000 by the Government to encourage and reward R&D within limited companies or PLCs.

For more information on R&D tax credits, or working with Amplifi Solutions to secure your claim, visit amplifi.solutions or call the team on +44 (0) 28 9008 0125.