Update – Read the latest updates and changes as of the Spring 2023 statement on 15th March 2023.

2023 will see R&D tax credits going through a period of beneficial reforms and controversial cost reductions.

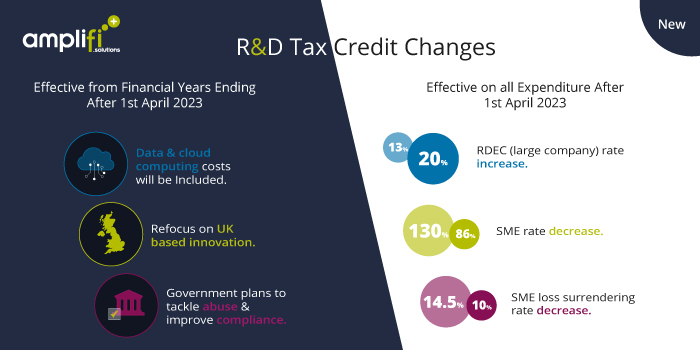

On the 17th of November, the Government delivered an Autumn Budget that had wide-ranging implications for many businesses. We explain the three key R&D tax credit changes that were announced and how they will affect innovative businesses R&D expenditure on or after 1st April 2023.

1. RDEC Rate Increase

The Research and Development Expenditure Credit (RDEC), which applies to large companies and SMEs, under certain circumstances (e.g. if they have particular grants or are subcontractors), will see a 50% rise in the relief they could receive, from 13% to 20%

2. SME Rate Decrease

Unfortunately, SMEs which have less than 500 employees and a turnover less than €100m or a balance sheet that totals less than €86m, will see a nearly 34% decrease in their relief as it drops from 130% to 86%.

3. SME Loss Surrendering Decrease

SMEs surrendering a loss will also see a decrease in the relief they can receive from 14.5% to 10%.

Earlier in 2022 the Government announced three, more positive reforms that would benefit UK based innovation and the R&D tax credit initiative, which will come into effect in April 2023.

1. Data & Cloud Computing Costs

Qualifying R&D project costs will include dataset licence payments, staffing data costs and cloud computing service costs.

2. Refocus on Innovation Based in the UK and Not Overseas

Third-party subcontractors and Externally provided workers (EPW) must carry out work in the UK and be on a UK payroll.

3. Tackling Abuse and Improving Compliance

The government are introducing a new cross-cutting team to tackle abuse and requiring more detailed claims to be submitted digitally.

View more R&D tax credit reform information

While the R&D tax credit changes are not all good news, there is the possibility to offset the reduction in the relief awarded with the inclusion of cloud and data costs, which is long awaited, but very much welcomed inclusion that will bolster the claims of many innovative businesses.